‘That’s disgusting.’ Owner of troubled daycare indicted on federal charges

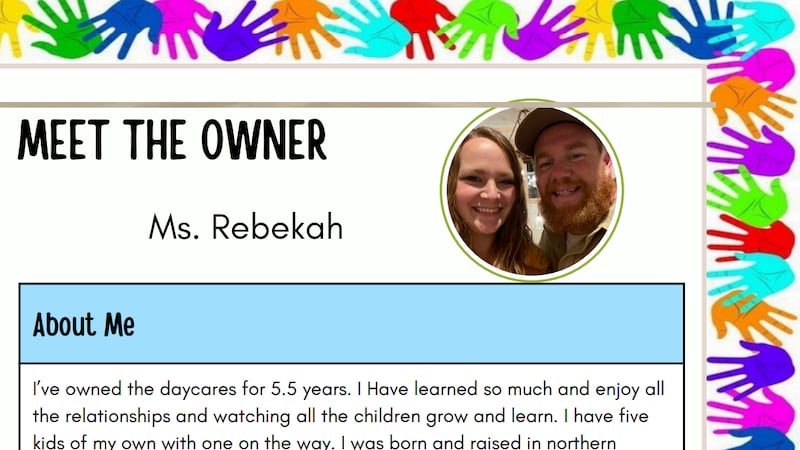

Franklin Springs Academy owner Rebekah Proctor is accused of using Paycheck Protection Program money that was meant for the daycare for her own personal expenses, and on the personal expenses of her husband.

NASHVILLE, Tenn. (WSMV) - In a stunning development, the owner of a troubled Middle Tennessee daycare has been indicted on 20 federal charges including wire fraud and failing to collect and pay taxes.

It’s the latest revelation in a string of investigations by WSMV4 News anchor Amanda Hara. Now, a former Franklin Springs Academy employee wonders if her tax troubles are connected to the criminal case.

“I just love kids,” Kaitlyn Adams explained. “I love watching them grow and experience new things and developing.”

From milestones to graduation ceremonies, Adams said there were sweet moments that came with helping run Franklin Springs Academy in Chapel Hill. But, she said those moments eventually soured and she blames the owner, Rebekah Proctor.

“I would just say the whole experience was like, shady,” Adams explained. She said she became increasingly suspicious after receiving a letter from the Internal Revenue Service regarding a delayed tax return.

“Come to find out, Franklin Springs Academy did not report the correct W2,” Adams said.

Some eight months after filing, Adams said she’s still waiting for what she expects to be a tax return check worth thousands of dollars. She said the IRS told her the check was tied up in what it would only describe as pending issues.

“I know the IRS said there were some pending issues against somebody but they wouldn’t tell me who or what it was,” Adams said.

The pregnant mother of two boys said she planned to use the money to buy a new car. One of her sons has a medical condition that requires frequent trips from her home in Pulaski to Vanderbilt in Nashville.

“My youngest has health issues and we live about an hour from Vanderbilt. I’ve got to have a decent car to do that. I don’t have a car that’s able to get an hour away,” she explained.

Adams is not the only one suspicious of Franklin Springs Academy owner Rebekah Proctor. A WSMV4 Investigation uncovered a grand jury indicted Proctor in February on 20 federal charges of wire fraud and not collecting or paying employment taxes.

The indictment alleges that Proctor failed to “account for and pay over the trust fund taxes due and owing to the IRS on behalf of the employees of Franklin Springs Academy.”

It describes trust fund taxes, or employment taxes, as being made up of Federal Insurance Contribution Act (FICA) taxes which represent Social Security, Medicare and federal income taxes. In addition to trust fund taxes withheld from pay, employers are also “required to make contributions under FICA for Social Security and Medicare in amounts matching the amounts withheld from their employees’ pay for those purposes.”

WSMV4′s reporting has uncovered even more. Prosecutors said Franklin Springs Academy received $224,600 in federal money in 2020 and 2021. The money came from the Paycheck Protection Program and was meant for things like employee wages. However, the indictment alleges that’s not where the money was spent.

As part of her first PPP loan application, the indictment claims Proctor certified she was current on her federal taxes, including payroll taxes. However, the indictment alleges, “That certification was false and the defendant knew it was false. At the time of the certification, the defendant had not filed any of the required Form 941 for her daycare business and had not made any of her required employment-tax payments since November 2017.”

The grand jury indictment also claims that Proctor said the PPP money would be used to retain workers and maintain payroll or make mortgage interest payments, lease payments and utility payments but instead, used “the funds to pay her own personal expenses and the personal expenses of her spouse.”

Former employee Kaitlyn Adams had no knowledge of the charges until she was informed about them by WSMV4. “So, they used day care money to pay for themselves? That’s disgusting. Disturbing. I have no words.”

Adams said the IRS told her it could be at least 60 days before she gets an update on her tax return which was filed back in March.

WSMV 4 has been reporting on other problems for Franklin Springs Academy for weeks. In our last investigation workers reported routinely late payroll and bounced paychecks. That’s despite the business getting more than $500,000 in federal money in 2023 as part of the American Rescue Plan to help childcare centers with costs like employee wages.

Franklin Springs Academy in Chapel Hill, which closed in September, was also at the center of a WSMV4 Investigation for allowing a teacher to continue working at the center more than a year after they were written up for pulling a child by their ponytail. The teacher was eventually convicted on charges of child abuse and assault.

Copyright 2024 WSMV. All rights reserved.